Last week my hubby and I had dinner with our dear friends Harry and Olivia. Towards the end of the meal Harry asked a very interesting question.

“When you pick up a menu, what side do you look at first – the right or the left?”

Harry and I immediately said “the right” while my hubby and Olivia both said “the left.”

What’s on the right side of a menu? The prices! What’s on the left? The food!

Harry’s question beautifully highlights a trend academics have long noticed – namely that we are often attracted to our financial opposites when it comes to financial behavior.

Our dinner conversation inspired me to consider other areas of our finances where behavioral patterns play a significant roll. Digging around, I was thrilled to discover fresh insights from Carl Richards* in his fantastic new book, The Behavior Gap: simple ways to stop doing dumb things with money. [*Carl Richards is a CFP, founder of Prasada Capital Management, and regular contributor to the New York Times Bucks Blog and NPR’s Marketplace Money. Carl is also famous for making his pithy points using a sharpie and a cocktail napkin.]

Our dinner conversation inspired me to consider other areas of our finances where behavioral patterns play a significant roll. Digging around, I was thrilled to discover fresh insights from Carl Richards* in his fantastic new book, The Behavior Gap: simple ways to stop doing dumb things with money. [*Carl Richards is a CFP, founder of Prasada Capital Management, and regular contributor to the New York Times Bucks Blog and NPR’s Marketplace Money. Carl is also famous for making his pithy points using a sharpie and a cocktail napkin.]

The Behavior Gap is the best combination of practical advice and emotional encouragement that I’ve seen in a personal finance book in quite some time. After reading this compelling work, I asked Carl some questions about his unique approach to assessing financial behavior:

MANISHA: In THE BEHAVIOR GAP you state, “Our conversations about money often leave us feeling confused, misunderstood, and even angry”. Why is this and what can we do about it?

CARL: Growing up most of us were taught that money, sex, and politics were not talked about in polite company, and see what that did to us! We have never really talked about money, and when we do, we expect it to be like math or spreadsheets…unemotional! Well, anyone who has been awake the last few years knows money is emotional! Changing this is simple…but not easy: start talking about it. Start with talking about where you are today, where you want to go. Give yourself permission to start exploring your relationship with money so you can change it!

MANISHA: One of my favorite points you make in THE BEHAVIOR GAP is “You’re Responsible For Your Behavior.” What behaviors do you find people most resistant to taking ownership of or changing?

CARL: Almost everything. Spending less than you earn. Saving. Investing with discipline. It is so much easier to blame others for our mistakes, big bad banks, Wall Street, credit card companies…but it does us NO good (even if its true). Better to just own up to it, learn from the mistake and move on!

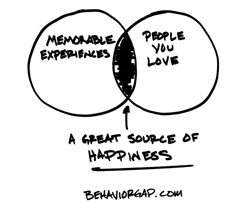

MANISHA: Of all the drawings you’ve created for THE BEHAVIOR GAP, when it comes to people finding true financial peace of mind, which one is your favorite and why?

CARL: Are you kidding! That is like asking someone to pick there favorite child, you might have one, but you could never admit it in public! Actually the sketch on page 62 (and to the right) is one that I try to remember everyday. We somehow forgot that the best source of happiness is SO SIMPLE: time with people we love! Of course we try to make it complicated and expensive…but it’s not. I asked one of my kids what their favorite memory of the summer was one year after we had taken a few trips and guess what he remembered? The time we spent throwing rocks in the pond! Not the trips! Not the hotels! Rocks and water? The reality is that it wasn’t about the rocks and the water either, it was about time together with people you love!

As I continue on with “MoneyZen” – my quest to help us all find less financial stress and more life joy, I am struck by the degree to which simply reflecting upon our behavioral patterns around personal finance can lead to greater personal fulfillment. Reading Carl’s delightful new book is a great way to jump start that process!

Have you shifted any financial habits lately that have led to great happiness?